Outside Pressures and Struggling Domestic Economy Means Slower Business Travel Growth in Brazil

In a report released earlier this week, the GBTA Foundation is forecasting slower growth for Brazil’s business travel spend. Brazil’s struggling domestic economy and the troubled regional economy are key factors in GBTA Foundation’s significant downgrade to business travel spend growth for the country.

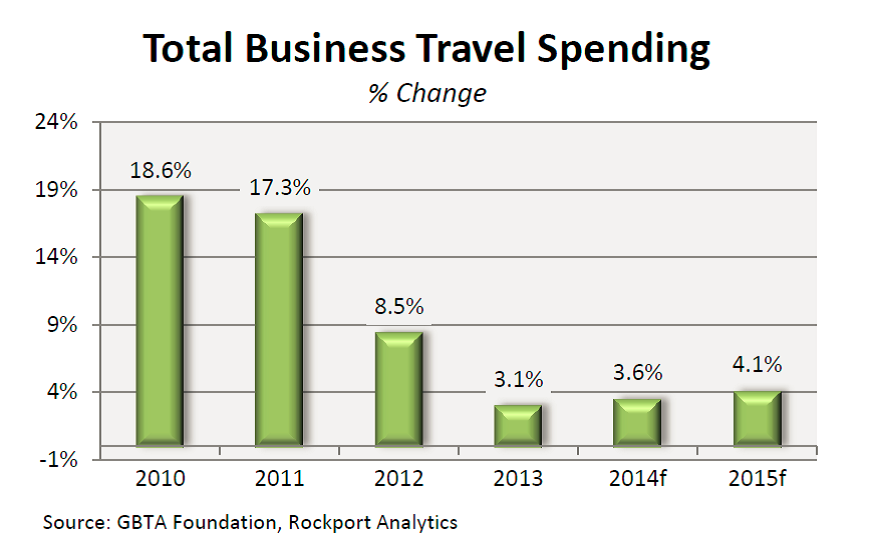

GBTA expects 3.6 percent growth in 2014 and 4.1 percent in 2015, down from our earlier projections of 12.5 percent and 5.9 percent. Total business travel spending in 2013 has also been revised to $30.8 billion from our estimate of $31.2 billion as business travel spending fell in the latter part of the year as the Brazilian economy weakened.

The country’s primarily consumption-driven economy is running out of steam to continue propelling growth as outside economic pressures and the domestic slowdown are forcing a slowdown in business travel growth. Uncertainty around the upcoming elections is another factor reducing growth in business travel locally. The previously expected growth in 2014 will be pushed further into the future and we now expect higher rates of growth to resume by the end of 2015. Even in light of this slowing growth, Brazil’s business travel industry surpassed South Korea to become the 7th largest market in the world.

There is a lot of speculation about whether or not the World Cup provided a boost. In terms of business travel and the overall economy, it’s just too soon to tell. While it brought more than a million visitors to Brazil boosting hotel, restaurant, retail, transportation and entertainment sectors; it also brought declared municipal holidays, worker absenteeism and a virtual standstill in many manufacturing and mining sectors.

Brazil desperately needs more help from exports if growth is to break out of the current doldrums. Stronger growth in China, Europe, Argentina and the United State – its key trading partners – is required with Argentina and Europe being the main sources of Brazil’s export struggles.

Despite infrastructure improvements leading up to the World Cup, the World Economic Forum ranked Brazil 114 out of 148 countries for quality of infrastructure, falling seven spots from last year. Brazil’s ability to improve this infrastructure will have enormous implications on business travel over the next 10 years in this market.